This was due to a combination of economic decline and a slump in the asset market, leading to a sharp decline in corporate taxes and income taxes, which are the main sources of tax revenue. However, the South Korean government will not issue any additional treasury bonds, and will use foreign exchange balancing funds etc. to

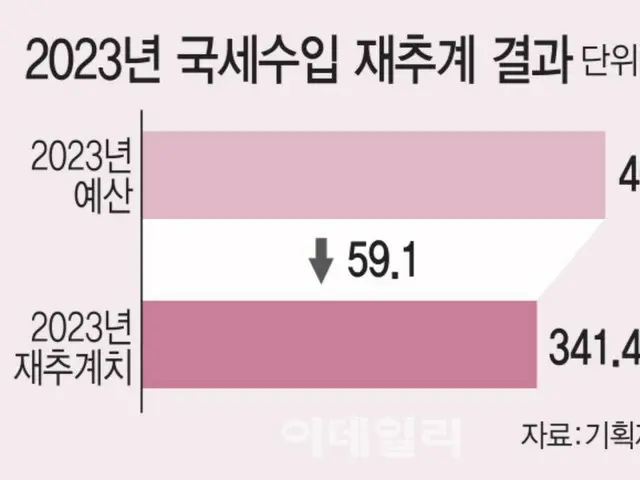

The plan is to maximize expenditures. The error rate when re-estimating the decrease in tax revenue was -17.3%, the largest overestimation since 1970. In addition, the size of the deficit

It's the biggest ever. This is the first time in 33 years that the Ministry of Planning and Finance has had a tax revenue error of more than 10% for three consecutive years, the last being from 1988 to 1990.

The reason for this large drop in tax revenue is the sharp decline in corporate operating profits. Global economic slowdown and slump in the semiconductor industry

Due to the slump in exports, companies' operating profits decreased significantly, and corporate tax revenues fell far short of initial expectations. Korea initially expected corporate tax revenue of 105 trillion won (approximately 11.7 trillion yen) this year.

The national government predicts that today's re-estimates will reduce collections by more than 25 trillion won (approximately 2.8 trillion yen) to 79.6 trillion won (approximately 8.9 trillion yen). Also, immovable

The slump in asset markets, including industrial production, also had an impact. Despite the decline in tax revenue, the South Korean government plans to proceed with its planned projects to support people's lives and economic vitality without any problems. However, the age at which deficit-deficit bonds are issued is

The shortfall in tax revenue will be covered by using excess funds such as the Foreign Exchange Balancing Fund and surplus funds, without making any corrections. In particular, funds including the Foreign Exchange Balance Fund (approximately 20 trillion won/approximately 2.2 trillion yen)

Approximately 24 trillion won (approximately 2.7 trillion yen) will be utilized from the country's surplus financial resources. However, the Ministry of Planning and Finance declined to state the exact amount of funds used.

Furthermore, the Ministry of Planning and Finance has come up with improvement measures to avoid repeating the errors in estimating large tax revenues. Private-public joint tax

It was decided to increase the participation of private sector experts in the revenue estimation committee and to receive technical advice from experts from international organizations such as the International Monetary Fund (IMF). We will also strengthen cooperation with the budget policy department of the Diet.

. Jeong Jeong-hoon, director of the Taxation Office at the Ministry of Planning and Finance, said, ``When we comprehensively consider fiscal response policies, the impact on people's lives and the macroeconomy due to the lack of tax revenue is extremely limited,'' adding, ``The impact of the lack of tax revenue on the people's lives and the macroeconomy is very limited.''

"We will work closely with departments and local governments to thoroughly manage the enforcement situation."

2023/09/19 07:15 KST

Copyrights(C) Edaily wowkorea.jp 107