There are concerns about how to make ends meet. According to the Ministry of Planning and Finance, the National Statistical Office will release the results of the ``Household Trends Survey for the Third Quarter of 2023'' on the 23rd. The household income trend survey measures household income and expenses.

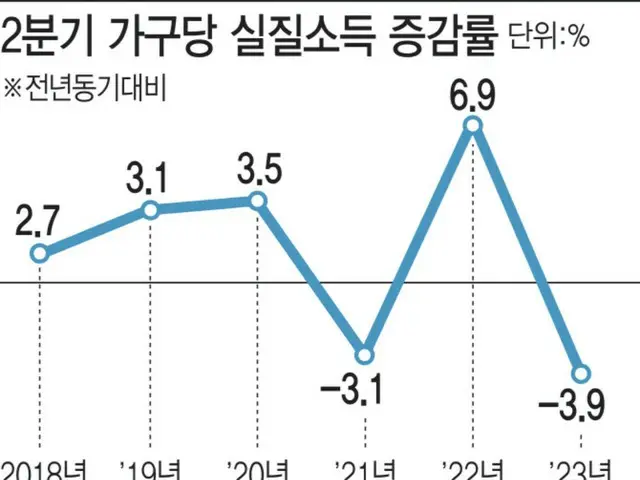

This analysis analyzes statistics on income and household income and expenditure indicators that link income and expenditure. According to the second quarter survey previously released in August, the average monthly income per household was 4.793 million.

won (approximately 558,000 yen), down 0.8% from a year ago. This was the largest decline since the third quarter of 2009 (-1.3%). Real income will further decline due to the impact of high prices

A little, 3.9% lower than the second quarter of 2022. This is the largest decline ever. The domestic price increase rate in South Korea, which had fallen to the 2% level in the middle of this year, has been affected by the rise in international crude oil prices and

The situation is unstable due to external influences, such as conflicts between Japan and Hamas. Looking only at the third quarter, the figure fell to 2.3% compared to the same month last year in July, rose again to 3.4% in August, and fell to 3.4% in September.

This further increased to 3.7%. Monthly price increases in the second quarter were 3.7% in April, 3.3% in May, and 2.3% in June. Compared to a year ago, the inflation rate will peak at 6.3% in July 2022.

After reaching the peak of The average monthly non-consumption expenditure including interest payments and social insurance premiums in the second quarter was 962,000 won (approximately 111,100 won).

0 yen), an increase of 8.3% from the same period last year. This is because interest payments increased by 42.4% compared to a year ago due to the impact of high interest rates. In contrast, non-consumption expenditures are subtracted from income.

The monthly average disposable income per household was 3,831,000 won (approximately 446,000 yen), down 2.8% from the same period last year and the largest decline since 2006.

This situation is expected to continue for some time as high interest rates continue in the third quarter. The Bank of Korea's standard interest rate, which is the standard for bank interest rates, increased from 1.0% at the end of 2021 last year.

After rising to 3.25% at the end of the year, it has remained at 3.50% since the beginning of this year. The retail sales index, a representative consumption indicator, fell 2.7% from the third quarter of last year to 200%.

This was the largest decline since the first quarter of 2019. Service industry production, another consumption indicator, rose only 1.9% as the rebound effect from the COVID-19 virus subsided, marking the first decline in two years and two quarters.

The rate of increase was low. Meanwhile, the Ministry of Planning and Finance will hold the ``11th Employment Task Force Meeting'' on the 21st to discuss recent employment-related issues. The Statistics Agency announced on the 15th “2023 October

According to the ``Monthly Employment Trends'', the latest monthly number of employed persons has been showing good performance, increasing the rate of increase for three consecutive months, but the number of employed persons in the manufacturing industry, which is considered to be a good place for employment, is also showing a recovery trend in exports. 10 months regardless

It is decreasing continuously.

2023/11/19 07:02 KST

Copyrights(C) Edaily wowkorea.jp 107