It's a prospect. The amount of arrears by self-employed multiple debtors amounts to 13 trillion won (1.45 trillion yen). Soaring prices and associated high interest rates are hitting micro, small and medium-sized enterprises, and self-employed people are facing a management crisis.

ing. While interest costs have increased by more than 10%, 40% of single-person CEOs are earning less business income than next year's minimum wage.

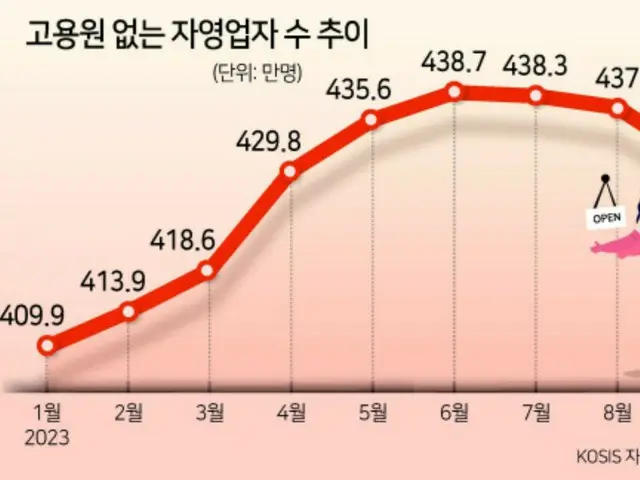

On the 5th, according to the National Statistics Portal (KOSIS)'s employment data by employment status, there were 438 single presidents in June this year.

7,000, but it decreased to 4,287,000 in October. There were 4,099,000 people in January this year, which has increased by about 300,000 people in the six months since then, but in the last four months (7

(Monday to October), there was a decrease of 100,000 people. In fact, the number of cases in which we receive support for the removal of closed stores is rapidly increasing. Is the office of ruling party ``People's Power'' member Chung Eun-cheon the Ministry of Small and Medium Enterprise Venture Enterprises?

According to documents obtained by the government, as of the end of August this year, the number of applications for small and medium-sized enterprises' businesses to support the removal of closed stores had reached 24,514. This is an increase of 1.4 times compared to the same period last year (16,887).

This seems to be due to a decrease in income. As a result of analyzing the household budget trend survey using Micro Data Integration Service (MDIS), the business income of the 5th quintile of single presidents increased from 2.52 million won in the first quarter.

I lost more than 200,000 won. The average business income for the 4th quartile is 1,968,000 won, which is the monthly salary (2,067,740 won) calculated from next year's minimum wage (9,860 won per hour) based on 209 hours of work per month.

(on). The decline in income for self-employed people appears to be due to a decline in consumption due to high prices and high interest rates. Consumer sentiment index (CCSI) for October was 98.1 compared to September (99.7)

It fell by 1.6 points. After rising to 103.2 in July of this year, it has fallen for three consecutive months. On the other hand, they are also worried about the sharp rise in interest costs due to high interest rates. Household budget with MDIS

According to the analysis of the trend survey, the interest expense for a single president increased from 109,000 won to 124,000 won, an increase of 15,000 won (13.7%). Also, regular workers

The increase was only 7.1%. If anything, the number of day laborers, other employees, and temporary workers has decreased. Micro, small and medium-sized enterprises will be pushed into crisis, and the possibility of huge debt defaults will increase.

Ta. According to the current status of loans for self-employed multiple debtors by city, which the Bank of Korea submitted to Representative Yang Kyung-sook (both Democratic Party) of the National Assembly Planning and Finance Committee, the number of self-employed multiple debtors at the end of the second quarter was

The number of heavy debtors reached 1,778,000. The amount of delinquency was 13.2 trillion won, and the delinquency rate was 1.78%. Approximately 2.5 times the delinquent amount of 5.2 trillion won at the end of the second quarter last year.

The delinquency rate also jumped from 0.75% to 2.4 times. The delinquent amount defined by the bank refers to the entire loan amount of self-employed multiple debtors who have failed to repay former interest for more than one month. The delinquency rate is

This shows the proportion of the amount of delinquency estimated as above in the loans of all self-employed multiple debtors. The smaller the company, the less able it is to withstand high interest rates. The balance of loans to small and medium-sized enterprises in the banking area exceeds 1,000 trillion won for the first time.

The number of small and medium-sized enterprises filing for bankruptcy also increased to the highest level ever. According to the Bank of Korea, as of the end of October this year, the outstanding loan balance of deposit banks to small and medium-sized enterprises was 998 trillion won, which was 3.8 trillion won in one month.

0 billion won increased. The figure for the end of November has not been announced, but considering the recent upward trend, it is certain that it will exceed 1,000 trillion won. SME loan balance is due to COVID-19 virus infection

Since then, the number has increased rapidly. Compared to the figure at the end of October this year, which was four years ago (end of October 2019) before the COVID-19 outbreak, the figure increased by 283 trillion won. The scale of the increase was 155 trillion won over the previous four years (155 trillion won).

) will be approximately twice as large. Small and medium-sized enterprises that were unable to fully recover from the damage caused by COVID-19 have struggled due to high interest rates and high prices, and loan delinquency rates have also increased. According to the Financial Supervisory Service and the Supreme Court, deposit

Gold Bank's delinquency rate for small and medium-sized enterprises loans in September was 0.49%, 1.8 times higher than a year ago (0.27%). This figure increased from 0.27% in September last year to 0.55% in August this year.

However, it declined slightly in September due to quarter-end amortization and sales. However, loan delinquency rates may rise in the future.

The number of corporate bankruptcy applications received by courts nationwide from January to October this year is also 1.

There were 363 cases, a 66.8% jump compared to the same period last year. This is the highest since 2013, when relevant statistics are available. Much higher than the existing maximum (1069 cases) in 2020, the first year of the COVID-19 outbreak.

It was. Most companies that file for bankruptcy are small and medium-sized enterprises. Roh Min-sung, a research member at the Small and Medium Enterprise Venture Research Institute, said, ``As high interest rates, high commodity prices, and oil prices continue, small and medium-sized enterprises will continue to face difficulties.

``The situation will continue,'' he said, ``Due to prices, it will not be easy to inject support funds, and if banks tighten lending, the possibility of small and medium-sized enterprises going bankrupt will become even greater.''

.

2023/12/06 05:46 KST

Copyrights(C) Herald wowkorea.jp 104