On the morning of the 19th, a cold wave continued with temperatures below -10 degrees. Mr. A, a man in his 70s who has no income this year, endures the cold weather while walking in Seoul.

He visited the Central Common People's Financial Integration Support Center located at the Press Center in Jung (Jung District), but was forced to give up on getting a loan and turned away. Mr. A said, ``What are you planning to do now?

"I can't help it," he said with a bitter expression on his face as he walked away. The high interest rate phenomenon that has continued since last year has brought about major changes in the lives of Korean people. Most of the people we interviewed and listened to said,

Recent changes in the economic environment, such as rising interest rates, have fundamentally changed their lives." Another person confessed, ``My household finances are reminiscent of wartime conditions.'' Real wages decrease and consumption

We are entering the era of the so-called ``return of high interest rates,'' in which interest rates will shrink significantly. In August 2020, Kim received a home equity loan with a fixed rate of interest for three years, followed by a variable rate of interest, in order to purchase her own home.

(38) has been nervous about interest rates since last fall. At that time, I received a loan with a three-year fixed interest rate of 2.12%, but after three years, the variable interest rate more than doubled to the mid-4% range.

It's because I got bored. Kim said, ``I received a loan of 300 million won (approximately 33 million yen) with a 30-year maturity, but the interest that used to be 530,000 won (approximately 59,000 yen) per month is now 1.15 million won (approximately 127,000 won).

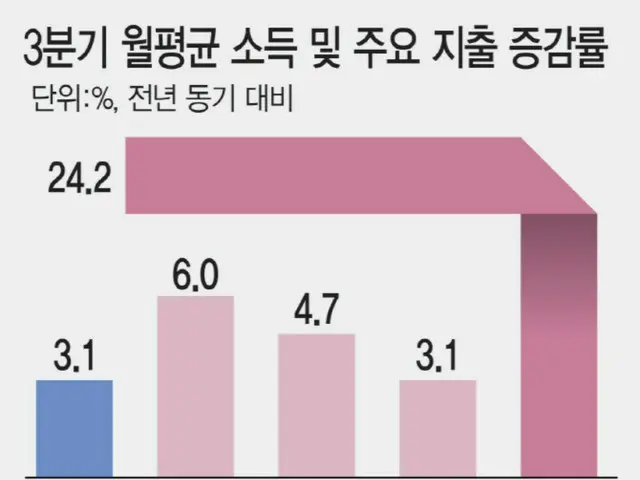

``I don't even have the money to eat out these days,'' he said. According to the Korea Statistical Office, high interest rates have increased the interest burden, and the average interest charge on household budgets in the third quarter of this year has increased.

It reached 129,000 won (approximately 14,200 yen), an increase of 24.2% from 104,000 won (approximately 11,500 yen) for the same period last year. During the same period, household provisional disposition income was 3.

The amount increased by 3.1% to 970,000 won (approximately 440,000 yen), but as interest rates remain high, the interest burden on households has recorded a double-digit increase rate for five consecutive quarters. Free consumption and savings due to high interest rates

As a result, the amount of temporary disposal income that can be earned by households is decreasing, and the burden on the household economy is increasing. According to the “2023 Household Financial Welfare Survey Results” released by the National Statistical Office, the Financial Supervisory Service, and the Bank of Korea, the average household

Interest costs rose 18.3% from the previous year to 2.47 million won (approximately 273,000 yen). This is the highest rate of increase since the 2012 survey. Burden of housing costs amid prolonged high interest rates

It's also weighing heavily on me. The average rent for an apartment in Seoul from January to November this year, as reported in the Ministry of Land, Infrastructure, Transport and Tourism's actual transaction price system, was 1.02 million won (approximately 113,000 yen).

I understand. 120,000 won (approx. 13,200 yen) compared to the average of 900,000 won (approx. 100,000 yen) in 2021, and 40,000 won (approx. 44,000) compared to last year's average of 980,000 won (approx. 108,000 yen)

yen) is rising in price. The signs of weakness continue to rise in consumer prices, and consumption is sluggish. According to the National Statistics Agency, the household budget trend survey for the third quarter of this year revealed that the average monthly income per household was

Quality consumption expenditure increased by only 0.8%. Professor Kim Sang-bong of the Department of Economics at Hansung University said, ``Once debt exceeds a certain level, it can be said to be just debt.''

If it gets even bigger, there is a big concern that people will not be able to consume much and it will lead to a long-term economic slump."

2023/12/20 07:03 KST

Copyrights(C) Edaily wowkorea.jp 107