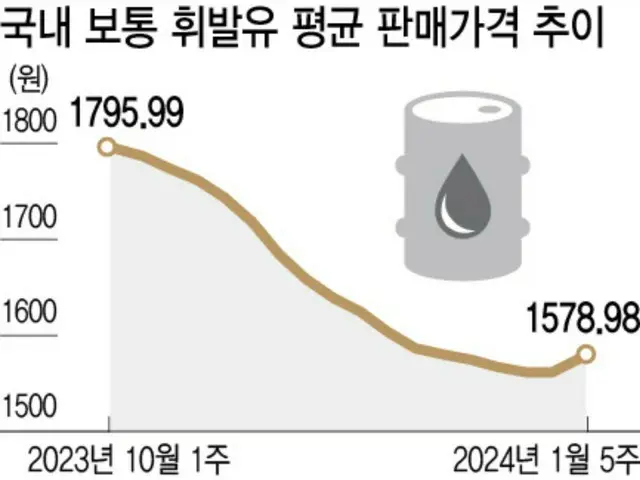

This is likely to be reflected in the selling price of the market, and a slight upward trend is expected for the time being. According to the Korea National Oil Corporation's oil price information system Opinet, the 5th week of January (January 28

(Sunday - February 1) The average selling price of gasoline at gas stations nationwide recorded 1,579 won (about 175 yen) per liter, an increase of 15.3 won (about 1.7 yen) from the previous week.

The average selling price of diesel oil during the same period was 1,485.9 won (approximately 164 yen) per liter, an increase of 12.9 won (approximately 1.42 yen) from the previous week, showing an upward trend along with gasoline.

By region, Seoul, the area with the highest price in the country, rose 2.45 won (approximately 0.3 yen) from the previous week to 1,663.6 won (approximately 184 yen), while Daegu, the lowest priced area, rose 2.45 won (approximately 0.3 yen) from the previous week to 1,663.6 won (approximately 184 yen), while Daegu, the lowest priced area, rose by 2.45 won (approximately 0.3 yen) from the previous week to 1,663.6 won (approximately 184 yen).

They each recorded an increase of 26.7 won (approximately 2.95 yen) to 1,547 won (approximately 171 yen). By trademark, GS Caltex gas station costs 1,587.5 won (approximately 175

The price was the highest at 1,543.9 won (approximately 170 yen), and the Arturu gas station was the lowest at 1,543.9 won (about 170 yen).

The weekly average sales price of Korean gasoline and diesel oil at gas stations is:

After falling in the second week of October (8th to 12th), it recorded an upward trend for the first time in 17 weeks. This comes after international crude oil prices exceeded $95 (approximately 14,095 yen) in mid-September for the Dubai oil standard.

This seems to be because the price fell to $71 (approximately 10,534 yen) on December 13th last year and then rebounded. The recently formed short-term high point for Dubai oil prices was on the 29th of last month at $83.31 (approximately 12,360 yen).

), and considering that international crude oil price fluctuations are usually reflected in Korean gas station sales prices after two weeks, a slight upward trend is expected for the time being.

The reasons behind the reversal in international crude oil prices include rising geopolitical risks and an increase in demand for crude oil due to global economic growth.

I can do that. Additionally, the International Monetary Fund (IMF) revised its forecast for the global economic growth rate upward from 4.2% to 4.5% this year, fueling a rise in international crude oil prices.

For the time being, international crude oil prices are expected to fluctuate due to geopolitical risks. Kim Kwan-rae, a researcher at Samsung Futures, said, ``In the Red Sea region, there is a

The military has carried out more than 30 attacks on ships in the past two months, reducing the total amount of cargo in Suez by 30%, and attacks by pro-Iranian militias on U.S. forces have greatly increased the possibility of friction between the U.S. and Iran.

did. If geopolitical risks are an upward factor for crude oil prices, the recent drop in expectations for interest rate cuts in March after the US Federal Open Market Committee (FOMC) meeting in January is a downward factor for gasoline prices.

It can be given as A researcher at Samsung Securities said, ``Since the FOMC meeting in January, expectations for an early interest rate cut in February have declined, and the continued decline in the Chinese manufacturing index has caused expectations for crude oil demand to decline.

``Recently, the upward adjustment of the IMF's economic outlook, the U.S. Department of Energy's purchase of additional strategic oil reserves, and the news of sanctions against Venezuela have limited the downward trend in crude oil prices.''

2024/02/04 21:31 KST

Copyrights(C) Edaily wowkorea.jp 78