The seminar was held in response to growing interest in the art investment market, which allows investors to invest in real estate, artworks, music copyrights, etc.

The event was organized to exchange opinions on real estate token securities. In his keynote speech, Kim Yong-beom, CEO of HASHED OPEN Research, said, "REITs and real estate

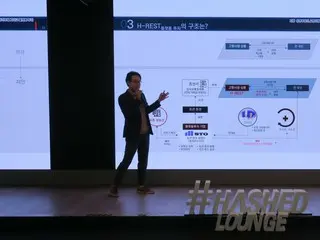

Real estate token securities can be divided into smaller amounts than funds and allow investors to invest in real estate with even lower liquidity without an institution. They are an investment product with high growth potential that does not require an intermediary and is easy to trade.

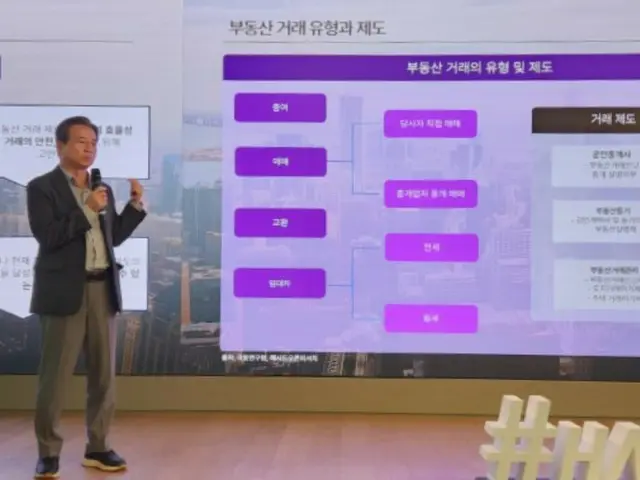

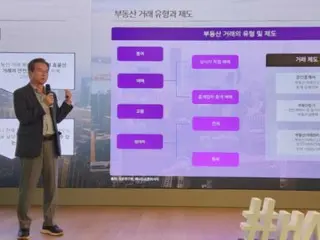

He also explained that while existing products are biased towards real estate investment, token securities are a further innovation in terms of the efficiency of real estate transactions.

Next, Min Go-hong, a researcher at HASHED OPEN Research, gave the example of the Japanese real estate token market, saying, "In Korea, real estate tokens have not yet been legalized.

"Compared to South Korea, Japan has a well-established system for real estate token securities, and the types and scale of tokenized real estate are becoming more diverse.

In fact, examples of real estate token securities in Japan include Nasu Outlet Mall (97.8 billion won) and River City 21 East Tower 2 (114.6 billion won).

) △ Kusatsu Onsen Ryokan (17.9 billion won) and others were introduced. In addition, "Recently, Japanese general trading companies such as Mitsui & Co. have also entered the token securities market," and "100 billion won (approximately 12 billion won)

"We are also proceeding with a large-scale token securities public offering of 10,000 yen (approx. 10,000 yen) and a public offering of residential facilities," he explained. Finally, "The advantage of real estate token securities is that they allow investors to invest in individual real estate projects.

"This will allow tokenized buildings to be used to expand beyond financial gain to include fandom."

Next, Song Ha-seong, a researcher at the Land Policy Research Center of the Korea Institute of Land and Infrastructure Management, said, “Real estate token securities are

The hometown love donation system can be a solution to the problem of vacant real estate in rural areas. The hometown love donation system is effective in providing financial support to financially disadvantaged rural areas.

"If we buy real estate in rural areas and generate revenue, we can compensate the donors and it may have an effect of revitalizing the rural areas," he explained.

The total amount will reach 65.1 billion won. Rather than receiving local specialties as gifts, receiving token securities invested in local real estate may generate sustained interest in the local community.

"It can be expanded in the form of non-fungible tokens (NFTs) and decentralized organizations (DAOs)," added Song. "Japan and the Korea Tourism Organization have already started digitalization with NFTs," he said.

"We are issuing residential ID cards to donors. It will also be possible to donate in the form of a DAO, where donors will have decision-making power over the operation and management of the property and receive discount coupons for businesses and coupons for exchange of goods," he explained.

Kim Yong-beom, CEO of HASHED OPEN Research, said, "This seminar will be the starting point for HASHED OPEN

Reserch is a blockchain and Web 3.0 specialized research institute that creates a real estate tokenization environment and develops blockchain technology.

"We plan to steadily study various current situations and their impacts so that we can utilize these technologies to ensure efficiency, safety, and public governance."

2024/07/10 14:23 KST

Copyrights(C)wowkorea.jp 5