(approximately 32 million yen), but lost the second trial. According to the legal community on the 19th, the Seoul High Court ruled that Bomboom Co., Ltd. (formerly Tree J

The appeal court for the lawsuit filed by the company against the head of the Gangnam tax office and the head of the Seoul Regional Taxation Office seeking the cancellation of the corporate tax assessment decision, etc., ruled in favor of the plaintiffs, just as it did in the first instance.

"Tree J Company" is an entertainment planning company founded and owned by Jang's mother, Jung. In December 2020, the company changed its name to "BomBom" and the following year

In March, Jung's sister became an internal director and CEO. The investigation agency conducted a tax audit on Bom Bom's fiscal years from 2012 to 2014 and found that Jung's activities in Japan were illegal.

The court determined that the company's earnings of 5.4 billion won (approximately 570 million yen) were missing and notified the Gangnam tax office chief of the tax documents. It also said that the earnings had been leaked outside the company and given to the company's mother, Jeong (62).

The head of the Gangnam tax office then determined that the company had been paid 420 million yen in corporate tax in March 2018, based on tax documents from the investigation bureau.

The company announced that it would pay 320 million won (approximately 34 million yen) in corporate tax. Bom Bom protested this, and the amount of corporate tax was reduced to 320 million won (approximately 34 million yen).

Bombom claims that the profits were not transferred to the company but were retained within the company, and requests that the notification of change in income amount and the imposition of corporate tax be cancelled.

However, both the first and second instance rulings found the tax authorities’ actions to be lawful. The second instance ruling found that “Company B had not recorded sales equivalent to the amount of the overseas deposit in its corporate accounting books.

Since it was not recorded in the books, we must assume that the entire amount was leaked outside the company," he said, adding, "Under this premise, the notification of changes in income amount is lawful."

The court ruled that the transfer of the amount back to the corporate account would not affect the punishment.

"Since Chung's tax liability has been established with regard to the above, the fact that Chung paid the repayment amount to Company B for reasons of sentencing in the criminal trial does not mean that there is a reason for requesting rehabilitation."

The court also ruled that the imposition of additional taxes for unjust under-reporting was lawful. The court said, "The amount of corporate income was paid through an overseas account that is difficult to trace, and it was not recorded in the accounting books, and corporate tax and value-added tax were not reported, so the tax payment was not made.

"The shortfall in sales amounted to 5.3 billion won, resulting in a decrease in national tax revenue," he said.

Meanwhile, Chung was indicted on charges of embezzlement and tax portals and sentenced to two years and six months in prison with four years of probation in the first trial.

In 2017, he was sentenced to a fine of 3 billion won (approximately 320 million yen) and his sentence was finalized.

2024/09/19 12:11 KST

Copyrights(C) Edaily wowkorea.jp 110

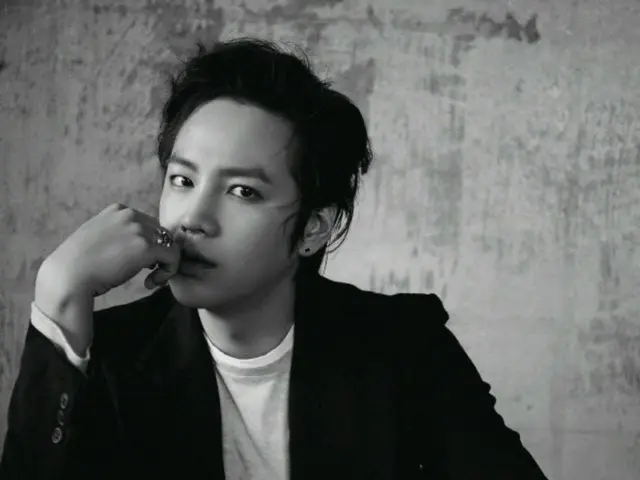

![[Official Report] TEAM H, led by Jang Keun Suk, had a blast at an early Halloween party! Jang Keun Suk's event will be held in December](/img/news/100/504627/409520_tmb.webp)

![[Photo] Kyu Hyun (SUPER JUNIOR), Lee Soo Geun, Eun Ji Won, and PD Na attend the production presentation of "Those Who Went to Kenya"](/img/topic/29/149940/301583_640W.webp)