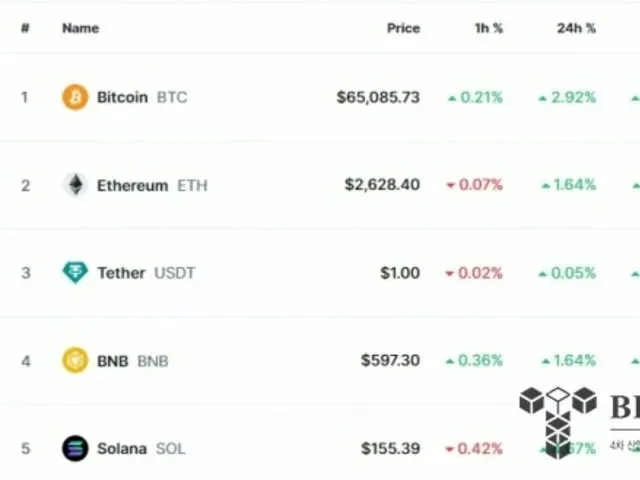

At 9:15 a.m. on the 27th, Bitcoin was trading at 60,000, up 2.92% from 24 hours earlier on CoinMarketCap, a global coin market relay site.

On this day, Bitcoin surged to $65,790. This is the first time Bitcoin has surpassed $65,000 again in about two months, since August 2nd.

Bitcoin's surge this year was driven by a massive influx of funds into Bitcoin spot ETFs. BlackRock's iShares Bitcoin Trading, the world's largest fund,

IBIT saw $185 million in inflows in just one day on the 25th, after a net inflow of $98.9 million the previous day.

This is because Bitcoin has recently shown a flat trend and ETFs have also been drawing funds.

The reinflow of funds into ETFs is likely to be due to the Fed cutting interest rates by 0.5 percentage points, followed by another 0.5 percentage point cut in interest rates.

This is due to the expectation that the price of Bitcoin will rise, and the fact that China announced a large-scale economic stimulus package, which has greatly improved investment sentiment. When Bitcoin rose, other coins also rose in unison.

Cryptocurrencies are all rallying, with Ethereum, the second largest by market capitalization, rising 1.64%, and Solana, the fifth largest by market capitalization, rising 4.67%.

2024/09/27 11:00 KST

Copyright(C) BlockchainToday wowkorea.jp 118