Julie Bittel, Head of Macro Research at Global Macro Investor

According to Bittel, the first reason for Ethereum heading towards the $10,000 target is its similarity to previous price fractals between January 2023 and March 2024.

The 2023-2024 fractal (black line) shows the ETH price consolidating between $1,500-$2,000 before breaking out to $3,500. The current price action (red line)

(See Image 2) If the price of Ethereum continues to move in the same direction and maintain the same momentum between January 2023 and March 2024, Ethereum will likely see a

Ethereum could experience a bullish breakout. Bitel indicates that Ethereum could reach $10,000 as a year-end target.

The second major catalyst for Ethereum to reach $10,000 is the long-term Fib retracement chart, the exponential moving average (EMA), and the weekly

Another fractal involving the Relative Strength Index (RSI) on the chart. Historically, Ethereum price movements have shown similarities between the 2017-2018 and 2020-2021 bull runs.

In the current setup, if Ethereum follows a similar trajectory, the rally that started from the 2022 low of $1,080 could reach the 1.618 Fib

It could aim for $6,978 (approx. JPY 990,000) with a Natch extension, and $10,623 (approx. JPY 1.51 million) with a 2.618 extension. (See Image 3)

The weekly chart of Ethereum is currently attempting to reclaim the 50-week EMA near $2,749.

The 200-week EMA at $2,104 has historically marked the bottom of major corrections. Meanwhile, the RSI is neutral at 46, far from being overbought, and momentum is sagging.

If Ethereum regains key levels and gains momentum, it could move in line with historical fractal patterns and technical indicators.

The third reason why Ethereum could reach $10,000 is due to broader macroeconomic trends, especially

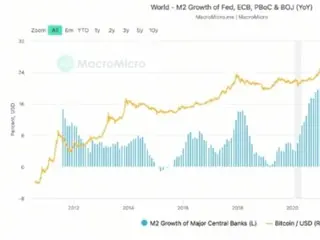

The increase in the global M2 money supply. As shown in the second chart, Bitcoin prices have historically risen in value relative to the Federal Reserve’s

This has moved in tandem with the increase in M2 money supply of major central banks such as the Reserve Bank, the European Central Bank (ECB), and the Bank of Japan (BOJ).

(See Image 4) From 2011 to 2020, Bitcoin experienced massive price increases during a period of active M2 expansion due to inflation concerns and increased liquidity.

While M2 growth contracted in 2022, in 2024, M2 growth shows signs of recovery as central banks ease monetary policy in response to economic uncertainty.

Since Bitcoin and Ethereum share a positive correlation, the rise in Bitcoin's price due to increased global liquidity will also boost Ethereum, pushing it to $10,000.

This can make the goals of the course more realistic.

2024/09/30 17:25 KST

Copyright(C) BlockchainToday wowkorea.jp 117