A sense of crisis is growing. Various indicators released recently show this. Retail sales have declined for two consecutive months, and the construction industry index has been deteriorating for six consecutive months.

Prior to this, the Bank of Korea lowered its economic growth forecast for this year from 2.4% to 2.2%, and next year from 2.1% to 1.9%. In addition, it said that the size of the Korean economy will remain at low levels until next year.

There are even predictions from international organizations that the growth rate will not reach the current level. This is raising concerns that a combination of a low birthrate and aging population, as well as problems with corporate innovation, could lead to a long-term structural slump.

They point out that the government should implement proactive fiscal policies to improve the dual structure of the labor market and innovate the economy.

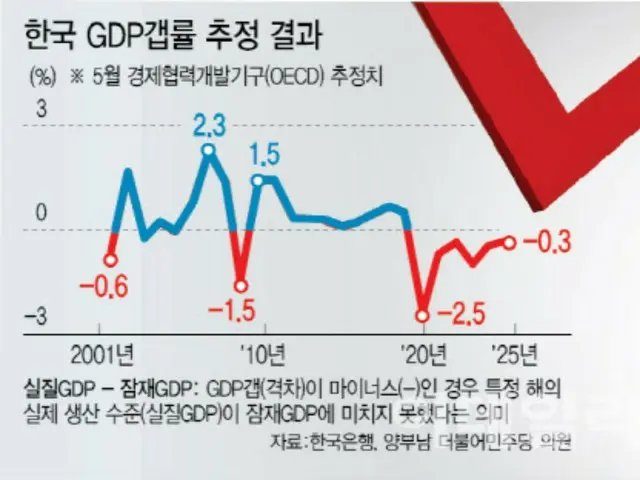

According to a document titled "Current GDP Gap between Korea and the G7 from 2001 to 2025" submitted to Rep. Bunam, the Organization for Economic Cooperation and Development (OECD) has a GDP gap of 2

It is expected to be negative for six consecutive years from 2020 to 2025. The GDP gap is the difference between potential GDP and real GDP.

This means that while there is little concern about rising prices, the economy is still sluggish and not even reaching its potential GDP. Potential GDP is the amount of inflation that would not rise even if the nation were to mobilize all of its production factors, including labor, capital, and resources.

The GDP gap rate for South Korea by year is minus 2.5% in 2020, minus 0.6% in 2021, and minus 0.5% in 2022.

It is estimated that the growth rate will be minus 0.3% in 2022, minus 1% in 2023, minus 0.4% in 2024, and minus 0.3% in 2025.

Until 2009, Korea had never recorded a negative GDP gap for two consecutive years. The fact that Korea has been stuck with a negative GDP gap for so long is not a short-term economic downturn, but a long-term,

"The GDP gap being negative for six consecutive years is a very bad sign," said Cho Young-moo, a research fellow at the LG Business Research Institute.

"This means that the economy is stagnating compared to the nation's strength," he said, adding, "However, if active fiscal spending is implemented to reduce the gap with potential GDP and interest rates are rapidly lowered, the fiscal deficit will increase.

"We are concerned that this will have side effects such as rising prices and the like," he said. The trend in industrial activity is also not good. Since the beginning of the fourth quarter, production, consumption, investment, etc. have all declined, resulting in a "triple slump."

Since May, all of these indicators have fallen for the first time in five months.

2024/12/02 07:01 KST

Copyrights(C) Edaily wowkorea.jp 107