After surpassing $100,000, the price of Bitcoin (BTC) plummeted to the $96,000 mark in a single day. As of 2:20 p.m. on the 8th, the domestic Bitcoin price on the Bitcoin exchange's Bitcoin exchange rate (BTC) was 1.1 times higher than the previous day's average.

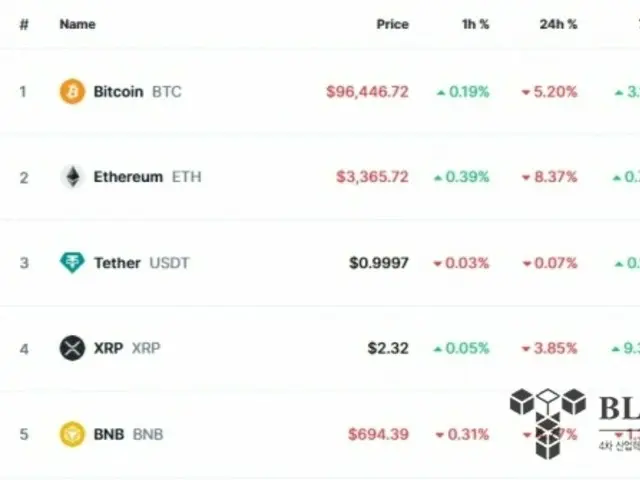

At the same time, the overseas Bitcoin price on CoinMarketCap fell 5.20% from the same time the previous day to 143.6 million won (approximately 15.61 million yen).

Bitcoin's price soared the previous day, exceeding $100,000 for the first time since the 20th of last month. Bitcoin then reverted to its previous high of $10,000.

On the same day, it fell to $96,440. Bitcoin spot exchange-traded funds (ETFs) saw a net outflow. A total of 457 million yen was withdrawn from Bitcoin spot ETFs on the 7th (local time).

The amount of funds lost was about $400,000 (about 72.3 billion yen). The drop in the price of Bitcoin was due to the Federal Reserve Board (FRB) deciding to withdraw funds from the Bitcoin Exchange after the U.S. economic indicators announced on the same day exceeded market expectations.

This is believed to be due to the expectation that the Fed will begin adjusting the pace of its interest rate cuts. The Fed's interest rate cut has shrunk market expectations that liquidity will increase in the cryptocurrency market, causing a decline in investment sentiment.

The analysis is that the number of job openings in November last year announced by the US Department of Labor on the 7th (local time) was 8.1 million, which was higher than market expectations (7.7 million).

This means that the US labor market is strong enough to justify raising the base interest rate. This, combined with concerns about rising prices in the US due to the outlook for a robust economy, has led the Fed to raise the interest rate.

Expectations for a cut in the benchmark interest rate in June appear to have dwindled. The Institute for Supply Management (ISM) released the U.S. Services Purchasing Managers' Index (PMI) for last month, which was compiled by the Dow Jones Industrial Average.

The PMI recorded 54.1, higher than the market forecast (53.4). The PMI is an indicator that predicts the future economic situation. A reading above 50 indicates that the economy is expanding, while a reading below 50 indicates that the outlook for the economy is shrinking.

According to the Chicago Mercantile Exchange (CME)'s FedWatch, the Federal Reserve Board (FRB) will decide on a standard rate of return at the Federal Open Market Committee (FOMC) meeting to be held on the 29th (local time).

The probability of interest rates being cut is only 4.8%. Normally, when base interest rates rise, investment demand for risky assets decreases, causing crypto asset prices to fall.

According to Alternative.mi, a crypto asset data provider, investment sentiment for virtual assets is in a "greedy" state.

The crypto fear and greed index on the 2019/10/23 was 70 points, down 8 points from the previous day. The closer this index is to 0, the closer the investment sentiment is to extreme fear, and the closer it is to 100, the closer it is to extreme optimism.

do.

2025/01/08 14:44 KST

Copyright(C) BlockchainToday wowkorea.jp 117