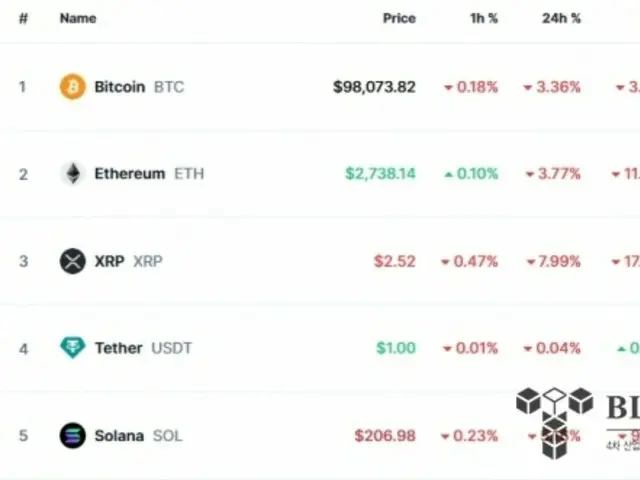

Bitcoin spot exchange-traded funds (ETFs) also saw net outflows. As of 10:50 a.m. on the 5th, Bitcoin was down 3.36% from the same time the previous day on CoinMarketCap.

It was $98,073 (about 15.06 million yen). Bitcoin fell back to the $98,000 level 30 minutes after President Trump imposed additional tariffs on China at 2 p.m. the previous day.

Bitcoin then rose to $100,677 at one point that morning, before falling again to $96,330.

The reason for the rise and fall in Bitcoin prices is the trade war between the US and China.

The day before, President Trump imposed an additional 10% tariff on China, and China responded by announcing retaliatory tariffs on U.S. imports.

On the same day, President Trump stated that he was in no rush to talk with President Xi Jinping, increasing uncertainty over the trade dispute. This led to a risk-averse mindset and a drop in the value of Bitcoin, a risk asset.

The price has fallen. There are also predictions that Bitcoin price fluctuations may become even more severe. Ryan Lee, chief analyst at Bitget Research, said:

"If selling is concentrated due to economic uncertainty, a short-term correction is possible," he said, adding, "Bitcoin could fall below $90,000."

The Bitcoin Spot ETF has turned into a net outflow. The Bitcoin Spot ETF has recorded a net inflow for four consecutive trading days since the 28th of last month (local time).

F lost a total of $234.4 million in funds on the 3rd of last month (local time).

2025/02/05 11:24 KST

Copyright(C) BlockchainToday wowkorea.jp 118