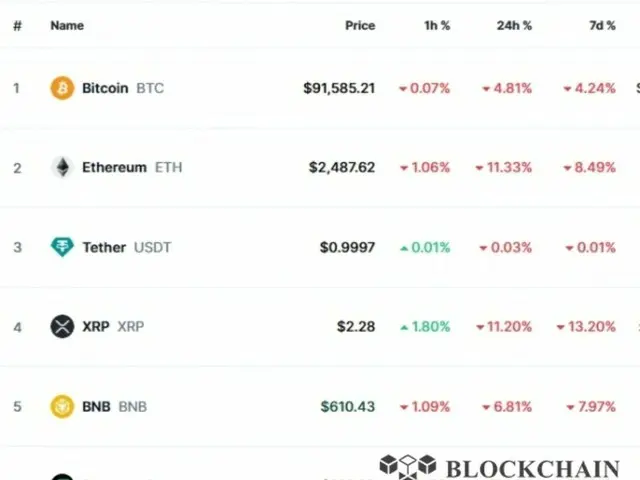

On the net cap, Bitcoin is at $91,585, down 4.81% from 24 hours ago. The collapse of the $92,000 level was the first in January.

This is the first time since the 10th. Bitcoin has fared relatively well, as other coins have crashed by over 10%.

Ethereum, the second-largest cryptocurrency by market cap, is trading at $2,487, down 11.33%.

Ripple, the fourth largest cryptocurrency by market capitalization, plunged 11.20% to $2.28. On the day, Ripple crashed more than 12% to $2.26.

Not only that, Solana, the sixth largest cryptocurrency by market capitalization, has plummeted by 16.14%, while Dozicoin, the eighth largest cryptocurrency by market capitalization, has plummeted by 14.44%.

This is first analyzed as being due to the ongoing Bybit shock. On the 21st of last month, Bybit stole $1.5 billion in Ethereum from a hacker believed to be Lazarus, who works with North Korea.

The hack caused a bank run of about $4 billion on Bybit. Bybit used its reserve funds to buy Ethereum and make up for all of the losses.

The hacking shock continues. Not only that, but it has been reported that a net outflow of $928.9 million has occurred into Bitcoin spot exchange-traded funds (ETFs) since the start of February.

The news has also contributed to the sharp decline in cryptocurrencies.

2025/02/25 11:31 KST

Copyright(C) BlockchainToday wowkorea.jp 118