In particular, there are growing concerns that the US economy will fall into stagflation (price rises during an economic downturn), and in South Korea, the momentum for price increases is also increasing amid the economic slowdown.

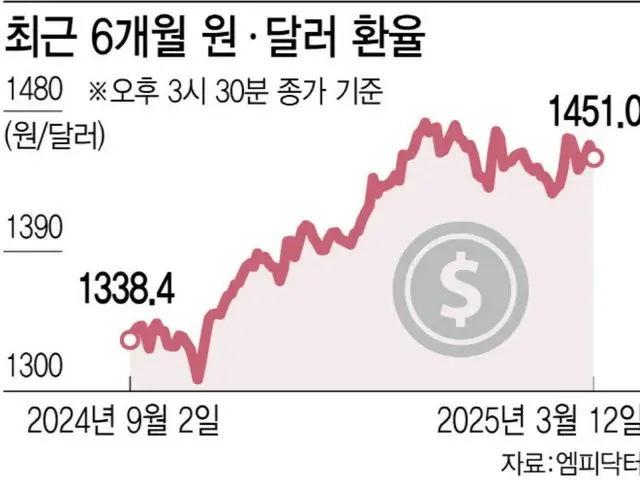

As of 3:30 p.m. on the 12th, the won-to-dollar exchange rate was down 7.2 won (0.4%) from the previous trading day's closing price of 1,458.2 won.

The won closed at 1,451 won, down 9%. Since November 6, 2024, when it topped 1,400 won during trading, the won had appreciated to 1,486.7 won on December 27.

However, on February 24, the won weakened to the 1,420 won range, and has since fluctuated around the 1,450 won range. The average exchange rate last month, based on closing prices, was 1,445.52 won.

Market experts believe that the exchange rate will not completely settle at the 1,400 won per dollar range, but there were no particular factors in the domestic economy or external factors that would cause the exchange rate to fall during the first half of the year.

The exchange rate is expected to remain at the 1,400 won level for the time being. The US dollar has been weakening somewhat recently due to US tariff policies and concerns about the economy, which has led to the dollar losing ground against the won.

The reason is that the supply and demand environment favorable to the US dollar is not likely to contribute to the downward stabilization of the exchange rate, and the fact that the US dollar is favorable is not a favorable factor.

"The rate is expected to remain in the range of 1,430 to 1,480 won per dollar during the first half of the year," he said, adding, "The ongoing trade friction originating from the United States is expected to be resolved through negotiations with various countries.

If they get their way, the dollar will weaken as the Trump administration wishes, and the former won will appreciate, which will likely lead to a rise in the won's value."

The exchange rate is expected to remain at 1,400 won per dollar at least through the first half of this year.

On top of that, there is also a possibility that international oil and food prices will rise, which could lead to increased pressure for inflation in the second half of the year.

"The news has come out that China's National Food Security Reserve Administration (NFSRA) will purchase oil for strategic reserves," said the official, adding, "If we look at past cases, it's a signal that the current crude oil price is at its bottom."

The Bank of Korea predicts that inflation will rise by 1.9% this year, but even if the exchange rate rises, the impact will be offset by the stabilization of international crude oil prices, and domestic demand will likely remain stable.

The main reason is that domestic demand is expected to be sluggish due to the slump, and the Korean government has a strong desire to stabilize prices. This is because international crude oil prices are rising and the domestic economy is recovering.

This means that if demand increases, inflation will be unavoidable. A Bank of Korea official said, "We expect domestic prices to remain generally stable this year, but geopolitical risks and tensions between major countries could lead to a rise in inflation."

"There are many unstable factors, such as trade friction between the two countries, exchange rate movements, and domestic demand," said Cho Young-gu, a research committee member at Shinyoung Securities. "We currently expect this year's inflation rate to be around 2%.

"However, we cannot rule out the possibility of prices soaring in the second half of the year," he said, adding, "Due to the unique nature of Korea, the prices of some items that are highly dependent on imported intermediate goods may rise sharply, or the perceived price level may rise."

There is a possibility that it could rise."

2025/03/13 07:04 KST

Copyrights(C) Edaily wowkorea.jp 107