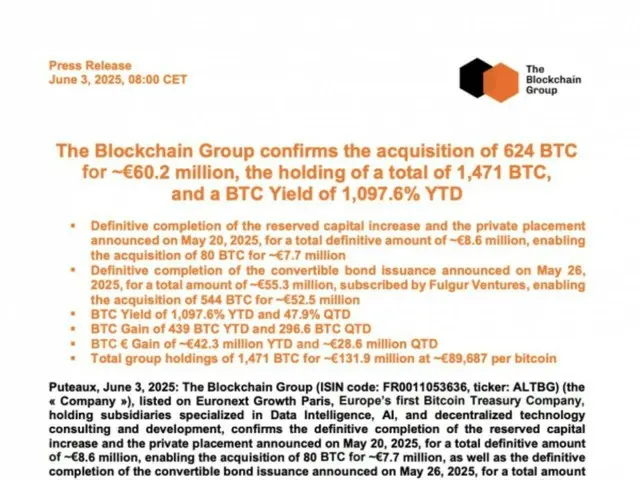

This is spurring a move in Europe to adopt Bitcoin as a strategy. On the 3rd (local time), Blockchain Group announced through X that it had secured 60.2 million euros (approximately 68.7 million yen) in funding.

This brings the company's total Bitcoin holdings to 1,471 BTC (approximately $154 million), and the company's earnings so far this year.

The profit margin is said to be 1097.6%. Blockchain Group calls itself Europe's first Bitcoin financial strategy company, and this purchase marks the first time that Bitcoin has been used by institutional investors.

The move comes amid a growing trend to consider Bitcoin as a financial asset. Corporate interest in Bitcoin financial strategies was fuelled by the launch of a physical Bitcoin exchange-traded index fund in January in the US.

This was further fuelled by the approval of an exchange-traded fund (ETF), which gave traditional financial market participants a way to invest in BTC in a regulated way for the first time.

In particular, on March 7, US President Donald Trump issued a presidential order outlining a national Bitcoin stockpile strategy that utilizes crypto assets seized during criminal investigations.

This led to a surge in corporate demand for BTC.

2025/06/04 11:25 KST

Copyright(C) BlockchainToday wowkorea.jp 118