The cryptocurrency hit a record high of $357.39 in November 2021, shortly after Coinbase went public.

Coinbase's price soared on the same day when the Federal Housing Finance Agency announced that it would suspend operations of home mortgage lenders such as Fannie Mae and Freddie Mac.

Securities specialist media Motley Pool analyzed that this is because the government ordered them to accept crypto assets (virtual currencies) as collateral.

Such moves are an extension of Trump's pro-cryptocurrency policies.

Motley Pool reported that this caused a rally in cryptocurrency-related stocks, including Coinbase and Circle.

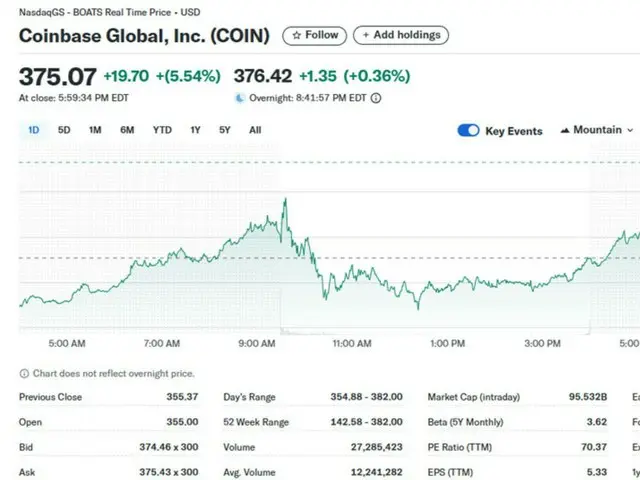

On the previous day in New York, Coinbase surged 3.06% to $355.37.

This comes after Bernstein analyst Gautam Chaudney described Coinbase as the “one-stop Amazon for cryptocurrency services.”

He said, "Coinbase provides not only cryptocurrency trading but also almost all cryptocurrency-related services," and "is like the Amazon of the cryptocurrency world."

In doing so, he gave the stock an "outperform the market" investment rating and significantly raised his target price to $510 from $310 previously, which is four times higher than the current price.

That means Coinbase has room to rise by more than 4%. The two-day surge has helped it rise 27% in the past five trading days, 42% in the month, and 51% so far this year.

.

2025/06/27 10:16 KST

Copyright(C) BlockchainToday wowkorea.jp 117