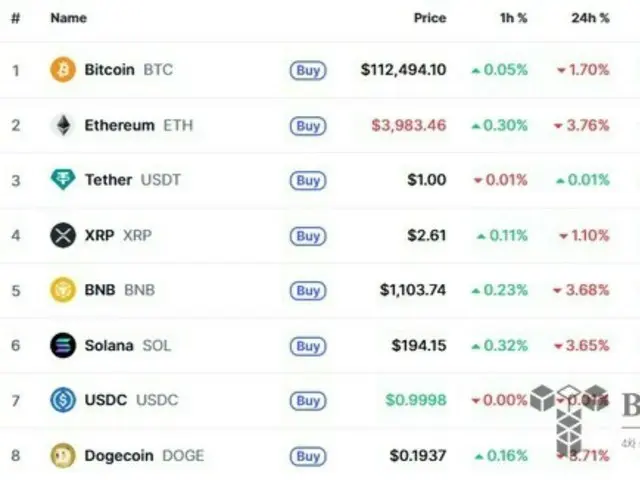

As of 11:05 a.m. on the 29th, according to CoinMarketCap, Bitcoin was down 1.70% from the same time the previous day to 110,240.

The price of Bitcoin recorded a high of $94 (approximately 17.1 million yen). The decline in Bitcoin is thought to be due to the booming US stock market, which has caused investment funds to move from crypto assets to the stock market.

On the 28th (local time), the S&P 500 index closed at 6,890.89, up 0.23% from the previous day, briefly surpassing 6,900 points for the first time in history.

The Stock Exchange Composite Index rose 0.80% to 23,827.49, and the Dow Jones Industrial Average rose 0.34% to 47,706.37, with all three major indexes hitting record highs either intraday or at the closing price.

The driver of this stock price rise was NVIDIA, a major American AI semiconductor company. The company announced a collaboration with Finland's Nokia, and its stock price rose by about 5%. NVIDIA is Nokia

He also announced plans to invest $1 billion in Kia's AI business and build seven AI supercomputers for the U.S. Department of Energy.

Cryptocurrency analysis firm Glassnode predicts Bitcoin will trade between 111,000 and 110,700

"The buying and selling battle continues in the $0 range," he said, adding, "The next trend will be determined when this price range is clearly broken above or below."

Meanwhile, Bitcoin spot exchange-traded funds (ETFs) have continued to see strong inflows, with net inflows for three consecutive trading days.

On the 27th (local time), $149.3 million inflows were recorded in one day.

2025/10/29 11:57 KST

Copyright(C) BlockchainToday wowkorea.jp 118