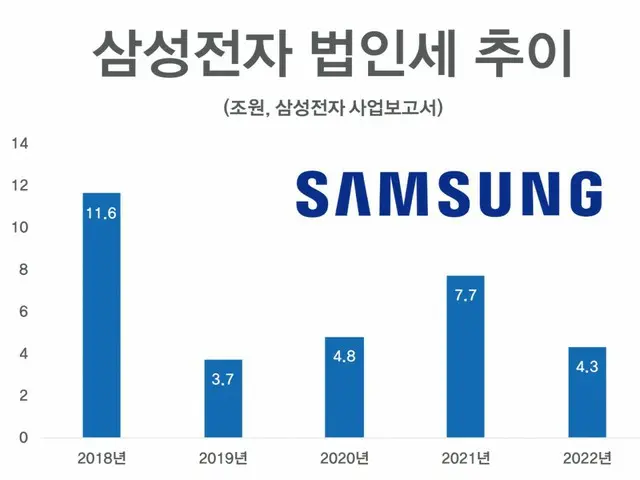

The corporate tax, which is the largest taxpayer, is expected to take a big hit as the earnings of Samsung Electronics, the largest taxpayer, plummeted due to the deterioration of the semiconductor market.

According to Samsung Electronics' semi-annual report on the 4th, corporate tax expenses for the first half of the year amounted to 241.2 billion won (approximately 26

700 million yen), down 97% from the first half of last year (7,107.1 billion won). Income tax expense is net income before income taxes minus net income for the year and is based on this year's results.

This is the estimated annual corporate tax to be paid in accounting. This is due to the sharp decline in operating income due to the deterioration of the semiconductor market this year.

According to the Korea CXO Institute, which specializes in corporate analysis, as of 2021, Korean corporate tax

Samsung Electronics accounted for 19.5% of the top 1,000 listed companies. Samsung Electronics will pay 7.7 trillion won in corporate taxes in 2021.

Meanwhile, until July of this year, South Korea's national tax revenue had decreased by 43 trillion won compared to the same period last year. Tax revenue performance continues to be sluggish, and the amount of tax revenue that is short of the proposed revenue budget is increasing every month.

According to the ``Current Status of National Tax Revenue in July'' recently released by the South Korean Ministry of Strategy and Finance, national tax revenue from January to July this year was 217.6 trillion won, up 43 trillion won from the same period last year.

400 billion won (16.6%) decrease. National tax revenue in July (39.1 trillion won) decreased by 3.7 trillion won compared to the same period last year, and the reduction in tax revenue until July decreased cumulatively until June.

This has further expanded from the total amount (39.7 trillion won). The rate of progress compared to the national tax revenue budget in July was 54.3%. Comparison of progress rate (65.9%) compared to last July's results and average results for the past 5 years

This was significantly lower than the progress rate (64.8%). Even if we collect the same amount of taxes as last year for the remainder of this year, this year's tax revenue will be 48 trillion won compared to the revenue budget (400.5 trillion won).

There is a shortage of funds. Looking at the current state of revenue by item, corporate tax from January to July was 48.5 trillion won, down 17.1 trillion won (26.1%) from the same period last year. Last year's corporate sales

This was due to a decrease in profits and an increase in interim prepayments and prepaid taxes. In July alone, corporate taxes decreased by 300 billion won from a year ago due to an increase in tax refunds.

Income tax revenue as of July was 68 trillion won, a decrease of 12.7 trillion won (15.8%) from the same period last year. July tax revenue is transfer office

The decline was 1.1 trillion won due to a decrease in income taxes, and the decline was even greater than the first half (11.6 trillion won). Value-added tax revenue up to July was 6.1 trillion won compared to the same period last year (

9.7%) to 56.7 trillion won. The ministry analyzed that there are impacts such as a decrease in income and base effects due to tax support.

Inheritance and gift taxes as of July were 9.1 trillion won, a decrease of 1 trillion won (9.6%) from the same period last year. July inheritance gift

Taxes decreased by 200 billion won due to a decrease in real estate gift transactions. Tariffs until July were 3.9 trillion won, a decrease of 2.6 trillion won (39.4%) from the same period last year, and July tariffs were due to a decrease in imports.

Due to factors such as this, the amount decreased by 500 billion won. The South Korean government has achieved real tax revenue excluding base effects such as last year's tax revenue increase (10.2 trillion won) due to tax support from 2021 to 2022.

The decline was estimated at 33.2 trillion won. The South Korean government is expected to estimate this year's tax revenue again and announce it early next month.

2023/09/05 06:57 KST

Copyrights(C) Herald wowkorea.jp 104