The result is worse than last year, when the government experienced a deficit, and this year too, warnings of a tax revenue saturation have been raised. According to the "Current State of National Tax Revenue in March" released by the Ministry of Strategy and Finance on the 30th, corporate tax revenue in March was 1

The figure was 5.3 trillion won (US$17.4 billion), down 5.6 trillion won (US$6.3 billion, -26.9%) from the previous year (20.9 trillion won, US$23.7 billion).

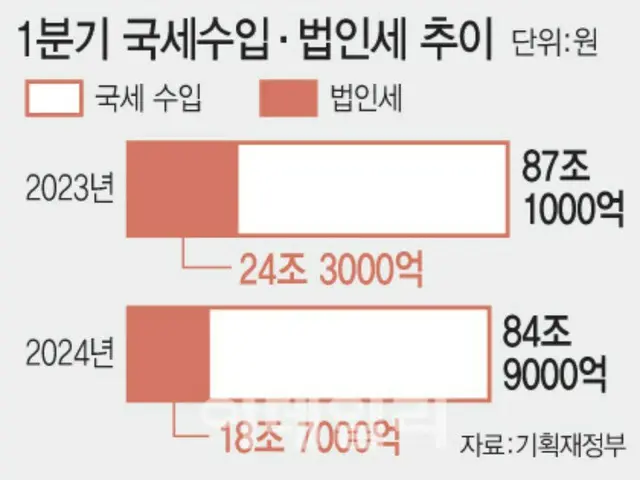

Cumulative corporate tax revenue from January to March was 18.7 trillion won (US$20.7 million), 5.5 trillion won (US$5.7 million) less than the previous year.

The reason why the March corporate tax is important is because it is the time when corporations with fiscal year endings at the end of December, which is the majority of Korean companies, file and pay corporate taxes.

The trend in corporate tax revenue in March is likely to continue for the rest of the year. As of March, the corporate tax progress rate (the total amount collected up to a certain point in time compared to the total budget) was 24.1%, the lowest in the past five years.

Cumulative national tax revenue from January to March was 84.9 trillion won (US$90.6 billion), also 2.2 trillion won (US$2.4 billion) lower than the previous year.

The progress rate of the cumulative standard national tax revenue in March was 23.1%, 2.8 percentage points lower than the past five years (25.9%). Professor Woo Seok-jin of the Department of Economics at Myongji University said, "The progress rate of national tax revenue is

"There is a strong possibility that the gap will widen further from the recent average," he said, adding, "It is highly likely that the tax revenue situation this year will also be severe."

2024/04/30 21:35 KST

Copyrights(C) Edaily wowkorea.jp 78