In addition to sales in South Korea, exports to customers in the U.S. and Japan increased, and the company was also boosted by the strong growth of its Chinese subsidiary.

Rival South Korea's Kolmar recorded its highest sales and operating profits in the quarter.

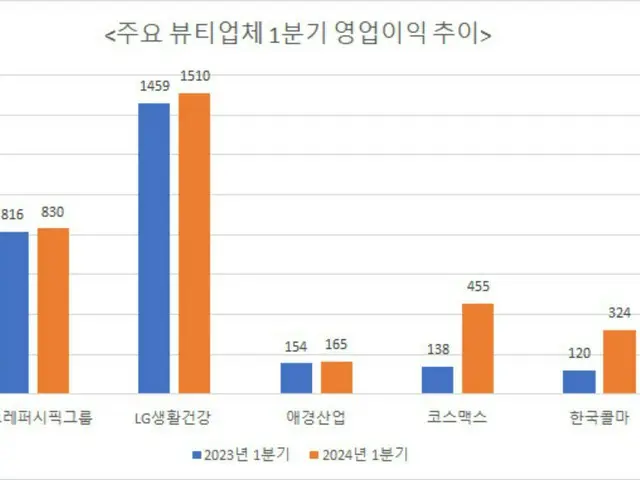

Meanwhile, cosmetics giant LG Household & Health Care recorded a 3.5% increase in operating profit to 151.9 billion won (about 17.318 billion yen),

Since then, the company has recorded growth for the first time in 10 quarters. With the rebranding of "The History of Hu," the brand was ranked #1 on the Chinese e-commerce site Tmall in March.

In addition to triple-digit growth in sales, the number of new customers at department stores also tripled. Amorepacific and Aekyung Industrial are also seeing a recovery in performance.

China was South Korea's main market for beauty industry during COVID-19

The company's performance has been sluggish and has been declining until 2023. In response to this, the company has embarked on a strategy of diversifying into overseas markets such as North America and Japan. In addition, the Chinese market has recently recovered, and the performance for the January-March period has been

This is believed to have led to improved performance.

2024/05/15 08:42 KST

Copyrights(C) Edaily wowkorea.jp 101