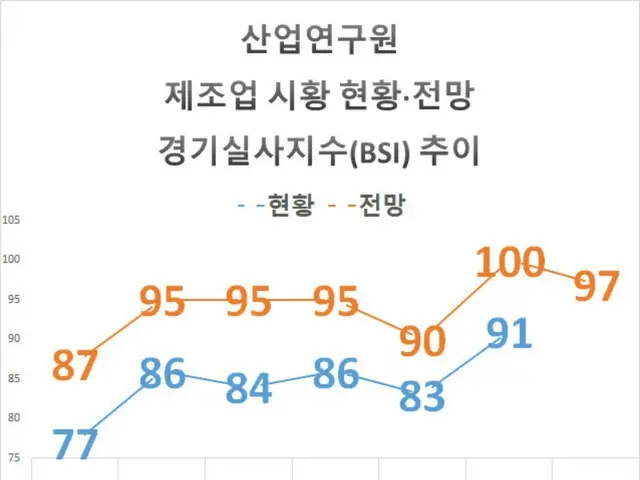

On the 14th, the Korea Institute for Industrial Economics and Trade conducted a survey of 1,500 manufacturing companies last month on the current state of the market in the second quarter and outlook for the current third quarter.

After quantifying the data, the Bank of Japan announced that its Business Performance Index (BSI) for market conditions in the second quarter was 91, up 8 points from 83 in the previous quarter.

The BSI is a system that converts the results of corporate surveys into positive and negative responses and converts them into numerical values between 0 and 200.

So, with 100 as the base, the more negative responses there are, the lower the score will be, and the more positive responses there are, the higher the score will be. The BSI for the second quarter was 91, which means that there are still many companies that responded negatively, but the proportion of positive responses is

This is the highest figure in two years and two quarters since the fourth quarter of 2021, when hopes for a recovery were high following the COVID-19 outbreak.

The export index rose from 88 to 99, the domestic demand (shipment to the domestic market) index rose from 83 to 92, and other indicators such as sales (82 to 94) and inventory (100 to 101) also rose.

By industry, the decline was in semiconductors (82→93), displays (85→104), wireless communication devices (72→91), automobiles (87→98), oil refining (80→102), and chemicals (85→97).

Most industries saw a large increase in positive responses. The market outlook index for the third quarter was 97, down three points from the previous quarter's outlook of 100. Sales (98), domestic market shipments (96)

Most of the detailed indicators, such as the semiconductor index (99) and the display index (101), remained at around 100, but expectations for an economic recovery were somewhat lower, especially in the domestic demand market.

7. Wireless communication equipment (105) continued to maintain a high level of expectations for economic recovery. Korea (92), refineries (97), steel (90), and textiles (86) had relatively low expectations for economic recovery, and secondary

Expectations for a sales rebound in batteries, which rose to 113 in the previous quarter, also dropped to 99. Companies cited the heavy burden of production costs, in other words the cost of second-hand goods, as the biggest bottleneck in their management.

This was cited by 57% of responding companies. Other concerns included slowing demand and inventory leakage (39%), the burden of capital management due to high interest rates (36%), and instability in the international supply chain (31%).

2024/07/14 13:48 KST

Copyrights(C) Edaily wowkorea.jp 91