According to documents received by Cha Gyu-geun, a lawmaker from the Fatherland Reform Party and a member of the National Assembly's Planning and Finance Committee, from the National Tax Service on the 15th,

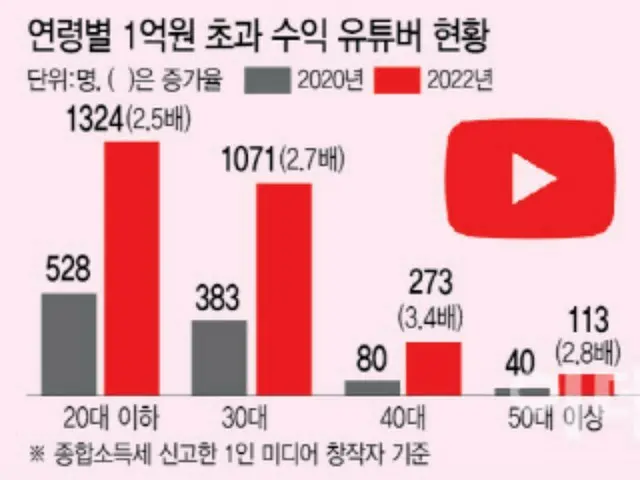

There were 1,324 individual media creators, including YouTubers and video streamers, under the age of 20 who reported income of over 100 million won in 2022. This is a decrease from 528 in 2020.

This is an increase of about 2.5 times. Among individual media creators, including YouTubers, the number of people who declare their income has been increasing every year, with 20,756 people in 2020.

The number of people who have filed for bankruptcy in 2020 will increase by 89.7% to 39,366 in 2022. The total amount of declared income will also increase from 452.1 billion won (US$490 million) in 2020 to 1.142 trillion won (US$490 million) in 2022.

A total of 2,781 individual media creators declared income of over 100 million won in 2022, outnumbering the total (39,366).

) About 7% of the total. By age group, the largest number of people were in their 20s or younger, followed by those in their 30s (1,071 people), those in their 40s (273 people), and those 50 or older (113 people).

In fact, according to NOOX influencers, as of the 15th, "Cre (Cre)," run by a couple in their 20s, was in the "Top 100 Korean YouTube Channels."

Among the top-ranked channels are "(Seungbini)," a channel focusing on short videos, and "(Seungbini)," a channel focusing on short videos. These channels have 24.7 million and 23.7 million subscribers, respectively.

The number of subscribers reaches 700,000. In the case of YouTube, paid advertising banners are displayed on videos, and YouTubers earn revenue when viewers watch the ads. The more subscribers a channel has, the more revenue it earns.

On the other hand, 31,481 people, or 80% of the total, declared their income to be less than 25 million won (about 2.85 million yen). The gap between rich and poor is clearly visible even among YouTubers.

However, this document does not fully reflect the income of individual media creators. The tax return documents analyzed by the National Tax Agency show that YouTubers have been depositing money into their personal accounts.

The tax office explained that when channel subscribers send tips to personal accounts, it is practically difficult to grasp the full breakdown of the transactions.

Rep. Cha said, "The number of independent media content creators across all age groups is increasing rapidly, and more of them are earning high incomes." He added, "The National Tax Service has recently been working to diversify the types of jobs available.

"Measures should be taken to ensure that no blind spots in taxation occur," he said. Meanwhile, Kang Min-soo, candidate for head of the National Tax Service, said in a written response to a personnel hearing he submitted to the National Assembly that he would not be able to provide support to individual media creators.

Regarding the anti-tax evasion measures, he said, "We are requesting the submission of foreign exchange receipt documents and business income payment details for income from the activities of YouTubers and video streamers," and "We will make monitoring more systematic."

"We will also tighten the submission of documents and thoroughly tax anyone found suspected of tax evasion," he said.

2024/07/16 07:03 KST

Copyrights(C) Edaily wowkorea.jp 107