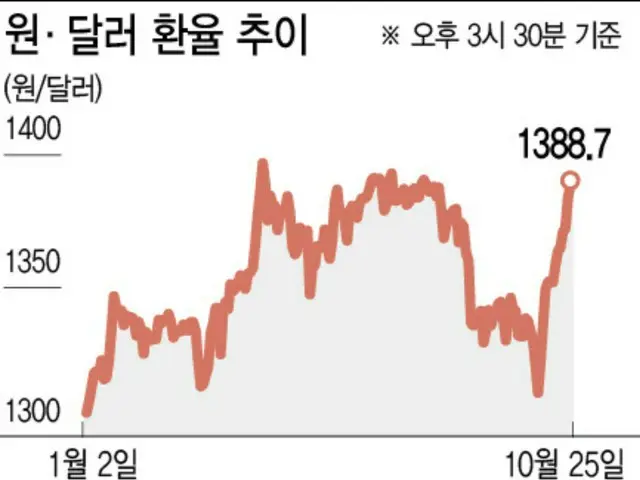

The exchange rate is approaching the 1,400 won per dollar (about 154.2 yen) threshold, raising concerns that foreign exchange authorities may intervene.

Attention is focused on whether the exchange rate will rise to 1,400 won or prevent it from rising to the 1,400 won range. In early trading on the 26th, the exchange rate rose to 1,392.2 won (about 153.34 yen) per dollar during trading.

It hit its highest price in about four months since hitting 1,395 won (about 153.65 yen) on June 27.

At the end of September, the exchange rate fell to 1,303.4 won (about 143.56 yen) during trading.

Since the start of October, the exchange rate has risen every day except for two days, soaring to 1,390 won per dollar. This means that the won has fallen by nearly 100 won in less than a month.

The recent rapid decline of the won against the dollar is largely due to the global weakening of the dollar. The US economy is booming, which has delayed interest rate cuts and led to the "Trump trade."

(investment in assets that will benefit if Trump is elected president) and the political instability in the Middle East has exacerbated the phenomenon of funds fleeing to the safe haven of the dollar.

As the exchange rate exceeded the 1,400 won per dollar mark, which is considered a de facto resistance level, foreign exchange authorities are wary of intervention.

When the exchange rate exceeded 1,400 won during trading in April, the foreign exchange authorities' verbal intervention was followed by an influx of funds that appeared to be actual intervention, limiting the rise in the exchange rate.

The United States and Japan jointly intervened in the market, and foreign exchange authorities implemented various measures to stabilize the market, such as increasing the national pension and currency swaps, preventing the exchange rate from falling below the 1,400 won per dollar level.

Authorities have also expressed concern about the won's accelerating depreciation, but it is unclear whether they view 1,400 won to the dollar as a resistance level.

Bank of Korea Governor Lee Chang-yong said on the 25th (local time) that "we are focusing on volatility rather than a target (specific exchange rate target value)."

Earlier, Deputy Prime Minister and Minister of Strategy and Finance Choi Sang-mok said on the 24th, "The current exchange rate should not be considered the same phenomenon as the same level in the past."

The current exchange rate level is qualitatively different from the rise in exchange rates at the time of foreign currency crises.

However, it is also understood that there is a mixed view that the current domestic and international situation does not pose any major problems for the exchange rate of 1,400 won to the dollar.

Market experts have mixed opinions on the drop in the exchange rate. NH Investment Securities analyst Kwon ARMY said, "When the economy is in a slump,

"However, with the current favorable U.S. economy and rising expectations for inflation, it is unlikely that the exchange rate will exceed 1,400 won," he said.

"There was also evidence of foreign exchange authorities' intention to intervene in an attempt to defend the 1,400 won mark in the second quarter."

In fact, the exchange rate hit 1,400 won per dollar in the second quarter.

It was revealed that the Korean won (KRW) was sold to the tune of about 6 billion dollars (about 918 billion yen) in an effort to stabilize the market, the largest amount of won selling in the past year.

However, some are of the opinion that the won may continue to weaken beyond 1,400 won per dollar.

"We don't think the exchange rate will surpass the 400 won mark," he said. "However, if Trump is elected, the Federal Reserve's policies will likely be offset, and the exchange rate will rise in the short term."

"The outlook is strong, so we need to be prepared for the possibility of it breaking through the 1,400 won mark."

2024/10/28 07:03 KST

Copyrights(C) Edaily wowkorea.jp 107