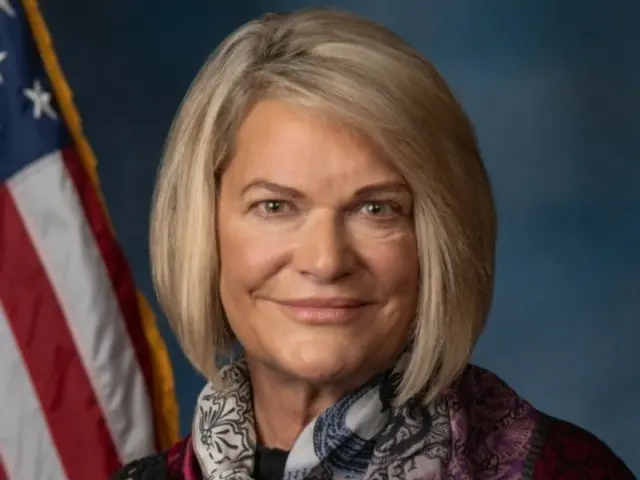

Congresswoman Cynthia Lummis, known as the "Queen of Crypto," has spoken out against Donald Trump.

A few hours after President Trump was re-elected, he released a Bitcoin strategic reserve proposal. The proposal has the potential to redefine the US fiscal strategy, but its feasibility and the US

Issues raised include the impact on bonds, policy barriers, and market volatility. According to reports, the United States has historically relied heavily on its gold reserves to stabilize and strengthen the dollar.20

As of September 2012, the United States holds approximately 8,133 tons of gold, far more than Japan's 845 tons and China's 2,113 tons. The eurozone as a whole holds approximately 10,784 tons.

Such a large amount of gold reserves contributes to the liquidity, security and stability of the national economy. In comparison, a hypothetical $200 billion worth of Bitcoin

The reserves of gold represent less than 2.5% of the current global gold reserves, raising questions about its strategic influence. The newly elected Trump Vance administration has asked the Treasury Department to consider investing in Bitcoin.

He could issue an executive order directing the allocation of specific funds for the purchase. In 2022, President Joe Biden plans to allocate 1.8 billion U.S. dollars from the Strategic Petroleum Reserve to respond to rising oil prices.

10 million barrels of oil. This time, treating Bitcoin as a strategic asset rather than a currency would allow it to avoid certain regulatory hurdles.

Additionally, a larger, sustained Bitcoin stockpile would require multiyear funding and would therefore require Congressional approval.

Cointelegraph reports that even though President Trump is pro-crypto, he has called Bitcoin a national asset speculative or risky.

Operationally, the U.S. Treasury could manage its Bitcoin reserves, just as it does with gold. Bitcoin is

The purchases would be made through various funds within the Federal Reserve System. There are several big challenges to implementing this plan.

The risks to the economy and bipartisan concerns about the long-term stability of cryptocurrencies are likely to be a focus of attention.

2024/11/07 18:01 KST

Copyright(C) BlockchainToday wowkorea.jp 117