Financial authorities are also becoming increasingly wary of card loans, but there are concerns that the availability of loans for individuals who are struggling with cash flow will become narrower.

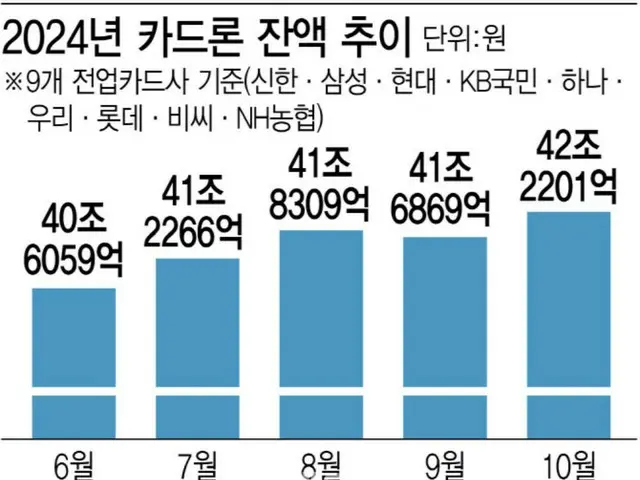

According to the Credit Finance Association, the total outstanding card loans of the nine major card companies was 42.22 trillion won (about 4.69 trillion yen) as of the end of last month.

This is an increase of 533.2 billion won (US$542 million) from last month, and 390.1 billion won (US$423 million) more than the previous record high recorded in August.

The number of unsecured loans was 100%. ...

Unlike traditional credit cards, you can apply for a loan quickly and easily without going to a bank or going through complicated procedures such as collateral, guarantees, or document submissions.

Because of the feature that you can receive a loan, card loans were a strong ally for people who were in financial difficulty. The outstanding balance of card loans, which had been breaking records every month, showed a slight decrease in September.

The two-stage stressed total debt-to-equity ratio (DSR) was implemented in September, and the financial authorities were affected by the balloon effect of the second financial sphere. Also, the card industry has been increasing its delinquency rate.

The impact of the write-off of bad loans at the end of the quarter to control the lending rate was also significant. However, the balloon effect caused by the lending restrictions in the first financial sphere began to grow in October.

In particular, it is analyzed that the bias toward those with medium and low credit ratings has become even more severe.

This is because savings banks that handle loans to large corporations have tightened lending restrictions, leading people with multiple debts to turn to credit card companies. Meanwhile, the average interest rate on card loans has remained high.

The average interest rate for card loans from eight card companies, excluding NH Nonghyup Card, was 14.44% as of the end of last month, up 0.13% from the previous month. Woori Card had the highest interest rate at 15.39%.

Lotte Card was at 14.93%, Samsung Card at 14.79%, and Hyundai Card at 14.48%. Meanwhile, the balance of not only card loans but also cash services increased from the previous month.

The balance of cash services was 6.8355 trillion won (US$7.59 billion), up 168.6 billion won (US$17.7 billion) from the previous month.

The outstanding balance of loans repaid from credit card companies that borrowed from the company also increased slightly from the previous month to 1.6555 trillion won (US$1.7 billion).

The outstanding balance was 7.1058 trillion won (about 789 billion yen), a slight decrease from the previous month. Financial authorities are becoming increasingly vigilant about card loans. The authorities will immediately raise the total amount of card loans.

Last month, financial authorities imposed restrictions on some card companies, such as imposing risk management plans. They will continue to control loan balances at least until the end of the year.

A source in the card industry said, "Most individuals who take out card loans tend to be heavily indebted, and interest rates tend to be higher regardless of their credit score.

"There is also a high possibility that card loan receivables will become bad due to delays in repayment, etc., so it appears that interest rates are being maintained at a high level."

2024/11/21 07:11 KST

Copyrights(C) Edaily wowkorea.jp 107