They believe that the supplementary budget will play a major role in boosting the economy, as the market has already factored in the possibility of additional bond issuance.

The size of the supplementary budget that has been under discussion in and outside the Korean government and the National Assembly recently is 10 trillion won (approximately

The budget ranged from 1.4 trillion won (US$10.4 billion) to 30 trillion won (US$30.2 billion). Some also discussed a 50 trillion won (US$50.2 billion) "super supplementary budget," but it was not enough to last two years.

The government is forced to take into consideration its fiscal situation, including a tax revenue deficit. However, given the shortfall in government revenue, it is unavoidable to issue deficit bonds. Deficit bonds are issued on a net basis, separate from bonds issued to create a market.

Therefore, if the number of bonds issued increases, the interest rate on government bonds will rise and the national debt ratio will increase. Furthermore, concerns about the country's credibility have been growing recently due to the declaration of martial law and impeachment issues, and the national credit rating has been declining.

The reality is that they have no choice but to be conscious of the grade. Looking at past supplementary budgets by the Korean government, government bonds have been used as a major tool along with excess tax revenues and the use of surplus funds.

Since the enactment of the National Finance Law in 2006, which stipulates the main principles of fiscal management, there have been nine cases in which the government secured funding through additional issuance of government bonds out of a total of 16 supplementary budgets.

In the past, at least 10 trillion won (US$20 trillion) was issued. If the supplementary budget this time is between 10 trillion and 20 trillion won (US$20 billion), it would fall within the expected range.

In fact, on the 6th of this month, the rating agency Fitch Ratings maintained its rating despite speculation that a supplementary budget would be implemented. Fitch said:

The recent increase in political instability is expected to continue in the coming months, but it is not expected to materially damage South Korea's institutions, governance or economy, it said, downgrading the country's credit rating to AA-.

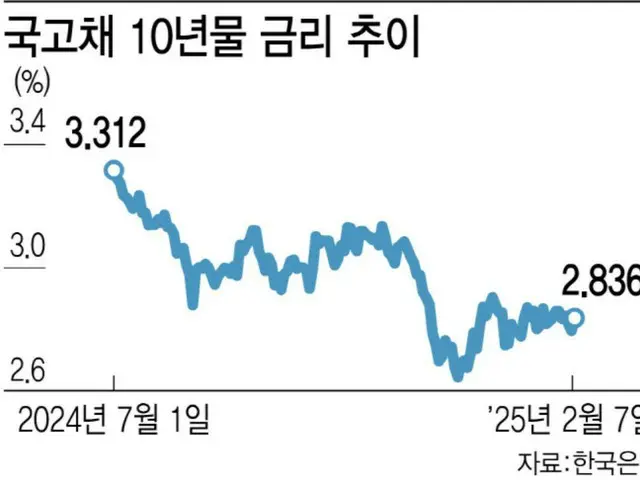

The market has already factored in the supplementary budget as a fait accompli. Compared to early December last year, when the martial law issue was in its early stages, the current long-term interest rate on government bonds is

The rate is about 0.2% higher. Normally, the market expects a 0.01% rise if the long-term interest rate per trillion won of deficit government bonds is high, but it is said that the possibility of a supplementary budget has been absorbed to some extent.

In addition, with the inclusion of the World Government Bond Index (WGBI) in November approaching, there is a possibility that supply and demand will improve as a result of the long-term inflow of funds from "big players" such as pension funds and asset management companies.

The total limit for issuance of treasury bonds by the Ministry of Strategy and Finance this year is 197.6 trillion won (US$205 billion), up 24.7% from last year and the largest ever.

The net bond issuance limit is 80 trillion won (US$80 billion), but if the supplementary budget becomes a reality, it could rise to more than 100 trillion won (US$100 billion).

"The supplementary budget is clearly a factor that will have a negative impact on the government bond market, but this has been factored in to some extent since last year," he said, explaining that "we will continue to stabilize the market and improve the system to achieve this."

Experts also predict that a supplementary budget is necessary given the current economic situation, and that if it is of an appropriate size, the government will be able to withstand the issuance of deficit bonds.

Professor Ng said, "The 20 trillion to 30 trillion won level is not a big shock to the market, and at a time like now when domestic demand is sluggish, the side effects of expansionary fiscal policy, such as rising prices, are expected to be fewer.

Professor Woo Seok-jin of the Myongji University Department of Economics also said, "The impression that the Korean government is not responding to the crisis is becoming an even more negative factor for its credibility abroad.

"I would like to ask for your cooperation," he said, emphasizing the need for a supplementary budget.

2025/02/10 07:10 KST

Copyrights(C) Edaily wowkorea.jp 107