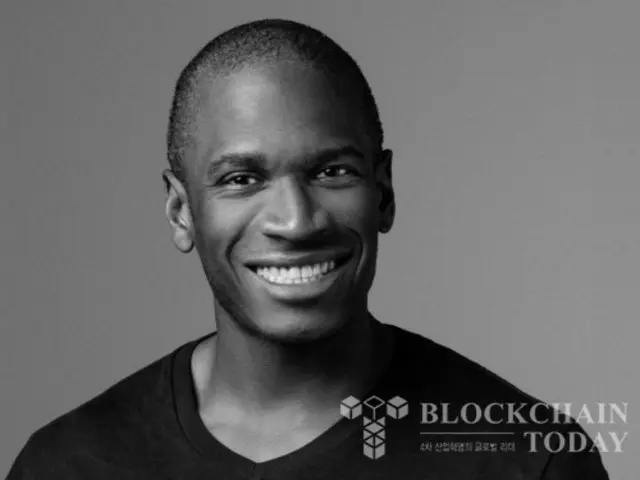

He warned that if the liquidation were to occur, the price of Bitcoin could fall to as low as $70,000. On the 24th, Hayes announced through X that Bitcoin was being sold to Goblin Town.

"The Bitcoin ETF market is heading for a massive outflow of funds from major physical ETFs, including BlackRock's iShares Bitcoin Trust (IBIT)," he said.

Hayes said many of the IBIT holders are hedge funds who buy the physical ETF and at the same time buy Bitcoin on the Chicago Mercantile Exchange (CME).

He explained that he had been using a strategy to pursue low-risk profits by short selling futures. However, the core of this strategy, the "basis spread,"

If the spread (the difference between the spot and futures prices) narrows, the hedge fund will liquidate the trade by selling IBIT and liquidating its CME futures position.

Now that these hedge funds have made profits and the basis spread has narrowed to the same level as the US Treasury yield, they are liquidating their positions at the US market opening.

Hayes added that there is a high possibility that the profits will be realized. Meanwhile, outflows from Bitcoin spot ETFs are in full swing. As of the trading day of the 24th, when the market crashed, 11 Bitcoin ETFs in the United States

A total of $517 million was withdrawn from the tocoin spot ETF, marking the largest net outflow in seven weeks and following five consecutive trading days of outflows.

Notably, BlackRock's IBIT funded $159 million, Fidelity's Wise Origin Bitcoin Fund

$247 million was withdrawn from the Wise Origin Bitcoin Fund.

Other companies include Bitwise, Invesco, and VanEck.

CoinGlass said it has seen outflows from major ETFs such as anEck, WisdomTree, and Grayscale.

lass) reported.

2025/02/26 16:25 KST

Copyright(C) BlockchainToday wowkorea.jp 117