BitMEX co-founder Arthur Hayes

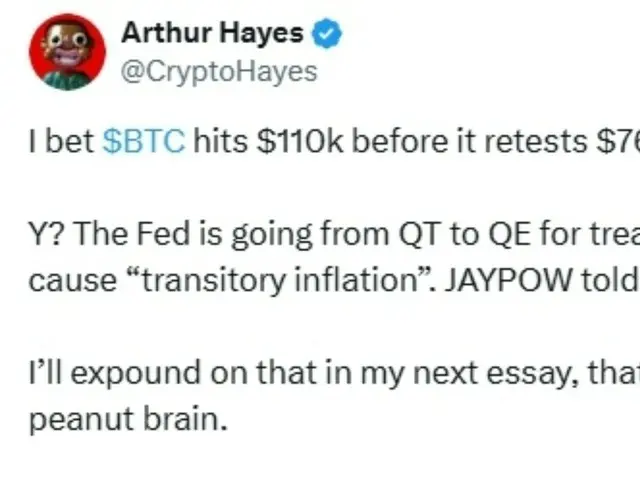

Hayes said via X on the 24th (local time) that "Bitcoin will hit $110,000 before retesting $76,500."

"It will reach $100 billion," he said, citing the Federal Reserve's shift from quantitative tightening (QT) to quantitative easing (QE) for government bonds as the main reason.

He also said, "My prediction is that the chances of Bitcoin reaching $110,000 are greater than the chances of it reaching $76,500."

"Once it hits $10,000, there's no looking back and it will go all the way to $250,000," he added. Quantitative tightening (QT) is when the Fed sells bonds or buys them as they mature.

Quantitative easing (QE) refers to the process of reducing the size of one's own assets without reinvesting the proceeds from bonds acquired. Quantitative easing (QE) is a policy in which the Fed purchases bonds to inject money into the economy, lowering interest rates and encouraging consumption and investment.

Other analysts have noted that the Fed has slowed its quantitative tightening but has not yet moved into full quantitative easing.

Benjamin Cowen, founder and CEO of Cryptoverse

Cowen said, "Quantitative tightening (QT) basically didn't end on April 1st.

"They're still getting $35 billion out of mortgage-backed securities every month. They've just slowed the pace of QT from $60 billion to $40 billion."

But other analysts see a high probability of Hayes’ prediction coming true. “Bitcoin has been growing at a rapid clip lately, and we’re seeing a lot of growth in the last 21 days,” said Ryan Lee, chief analyst at Bitget Research.

The bullish momentum continues, with prices breaking above the 1, 200-day and 200-day moving averages, a trend consistent with Hayes' outlook. However, the resistance at $88,000 remains a major obstacle.

"It has become like that," he said.

2025/03/26 11:13 KST

Copyright(C) BlockchainToday wowkorea.jp 118