On March 11th, Bithumb, a domestic cryptocurrency exchange, listed XEBEC (ZBCN) as a cryptocurrency issuer or operator.

The company was designated as a stock with trading caution due to the fact that the entity had not disclosed important matters that could have a significant impact on the value of virtual currency and that the existence and sustainability of the business was unclear, and was subsequently delisted on March 24.

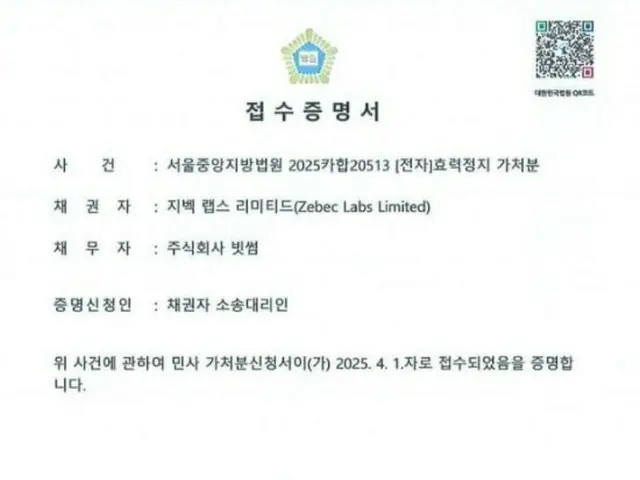

Xebec announced on its official Telegram channel and Twitter that it would take legal action against Bithumb's decision together with its Korean legal team.

Xebec stated, "The Korean community and the exchanges that support it are very important to us, and we will use all legal means to resolve this case.

"We have responded to Bithumb's inquiries in a manner that far exceeds the standard listing and compliance requirements. We are pleased to see that Bithumb has been approved by ZBC.

We respectfully request that the documents submitted be thoroughly and carefully reviewed before making a final decision on N." Recently, such applications for provisional injunctions against exchanges have attracted public attention.

The courts have so far rejected all applications for provisional injunctions filed by domestic virtual currency projects against exchanges, and have recognized the exchanges' authority to decide whether or not to support transactions.

However, in July last year, Bithumb's Cent (formerly Enterburton) filed a provisional injunction against Bithumb to suspend the delisting decision, which was granted.

On July 8, 2012, Bithumb confirmed that Cent would be delisted at 3 p.m. and notified Cent of the schedule for withdrawal support.

Meanwhile, at the National Assembly Forum for the Enactment of the Basic Law on Digital Assets held on the 24th of last month, DAXA, a consortium of Korea's five largest virtual currency exchanges, announced that

In response, he said, "I am concerned about whether DAXA is functioning properly as an autonomous organization," and "I want to create a harmonious structure that can protect virtual currency users by taking such aspects into consideration."

"The virtual currency business has been structured in an anomalous way," he said. "Currently, individual investment in virtual currencies is limited in South Korea, and a lot of power is concentrated in the hands of exchanges.

"We are," he said.

2025/04/02 20:23 KST

Copyright(C) BlockchainToday wowkorea.jp 99