NVIDIA once again took the top spot, solidifying its position as one of the world's most valuable companies. On this day, NVIDIA's stock price rose 4.33% from the previous day on the New York Stock Exchange.

The stock closed at $154.31 on Tuesday, beating its previous all-time high of $149.43 recorded on January 6th of this year. It has surged 63% since its April low and is the largest stock price in that period.

Its market capitalization has increased by more than $1.4 trillion, up more than 11% so far this year, and is set to soar by 170% in 2024 and over 240% in 2023.

This brings Nvidia's market capitalization to $3.763 trillion, overtaking Microsoft to become the world's most valuable company once again. Apple comes in third with a market capitalization of about $3 trillion.

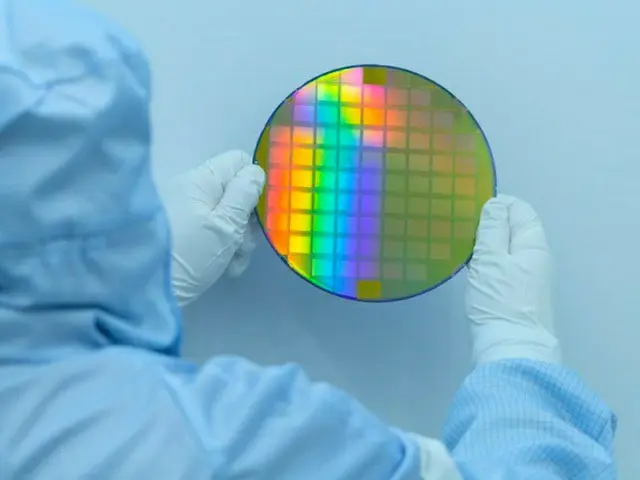

Nvidia boasts an overwhelming share of the GPU (graphics processing unit) market, which is essential for the development of large-scale language models (LLMs) and AI calculations.

Investors remain confident in Nvidia's technology and growth prospects, despite the government's tightening of export controls on China and a sharp decline in sales there.

Major clients such as Alphabet (Google's parent company) and Amazon also continue to expand their AI-related investments, and these four companies account for more than 40% of Nvidia's total sales.

Nvidia's business has been growing steadily, but in April of this year, the Trump administration imposed additional export bans on the AI semiconductor "H20" that the company developed to circumvent the regulations.

As a result, Nvidia has revealed that it expects to incur sales losses of around $8 billion and inventory write-downs worth $4.5 billion. In addition, the U.S. government has announced that it will impose sanctions on AI semiconductors.

The company is also said to be considering further strengthening export controls. Nevertheless, Nvidia's performance continues to improve. In its financial results announced in May, the company reported a 69% increase in sales compared to the same period last year.

In particular, sales in the data center division surged 73%, driving overall performance. According to research firm LSEG, Nvidia's annual sales for this year are expected to reach $200 billion, up 53% from last year.

Optimism about Nvidia's stock remains dominant on Wall Street, with about 90% of analysts rated as "buy" by Bloomberg.

The current price-to-earnings ratio based on expected earnings is also lower than the historical average, at about 31 times, which is lower than the average of the Nasdaq 100 Index.

"The AI technology race will be over by 2025," said Michael Smith, co-portfolio manager at Allspring Global Investments.

"NVIDIA's growth has picked up momentum again and its market dominance has strengthened," he said.

Nvidia CEO Jensen Huang also spoke at the company's shareholders meeting on the same day.

"Demand for AI remains strong and the computing industry is in the early stages of a major transformation to AI infrastructure," he said.

2025/06/26 09:46 KST

Copyrights(C) Edaily wowkorea.jp 88