According to The Block, on the 9th (local time), Strive, a Nasdaq-listed structured finance company that operates Bitcoin financial strategies, announced that it would acquire SATA preferred stock.

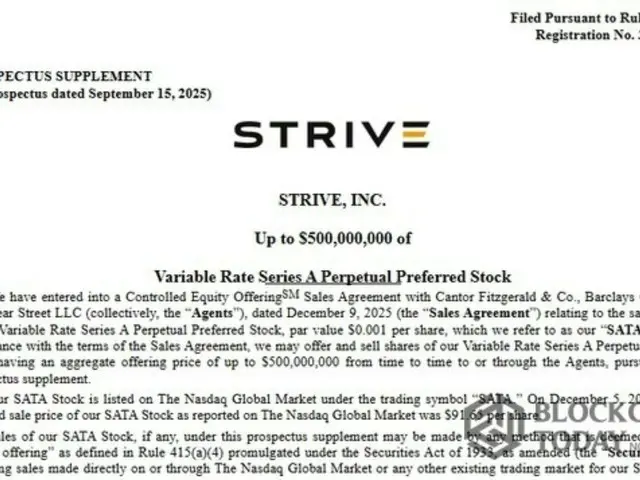

Strive announced that it will launch a $500 million public offering of its ATMs.

Distribution agreements have been signed with Fitzgerald, Barclays and Clear Street, enabling the company to supply SATA shares directly to the market.

By utilizing an ATM structure, Strive can sell shares at market prices multiple times over a period of time depending on market conditions, rather than issuing them all at once at a fixed price.

SATA's dividend rate is set at 12.00% per annum, with regular dividends calculated based on the issue date of November 10, 2025. Strive will then

Strive added that it also has the authority to adjust the program.

Building on the success of the IPO, the company plans to use the token not only for general corporate purposes but also for additional Bitcoin transactions.

On November 10, Strive launched a public offering of SATA shares at $80 per share (approximately 12,550 yen), exceeding its initial target of 1.25 million shares.

SATA announced that it had completed its IPO, expanding the offering size from 10,000 shares to 2 million shares, and began trading on the Nasdaq Global Market.

2025/12/10 19:44 KST

Copyright(C) BlockchainToday wowkorea.jp 99